What Kind of Insurance Do I Need for a Pressure Washing Business?

- Nate Jones, CPCU, ARM, CLCS, AU

- Aug 4, 2025

- 2 min read

Updated: Oct 2, 2025

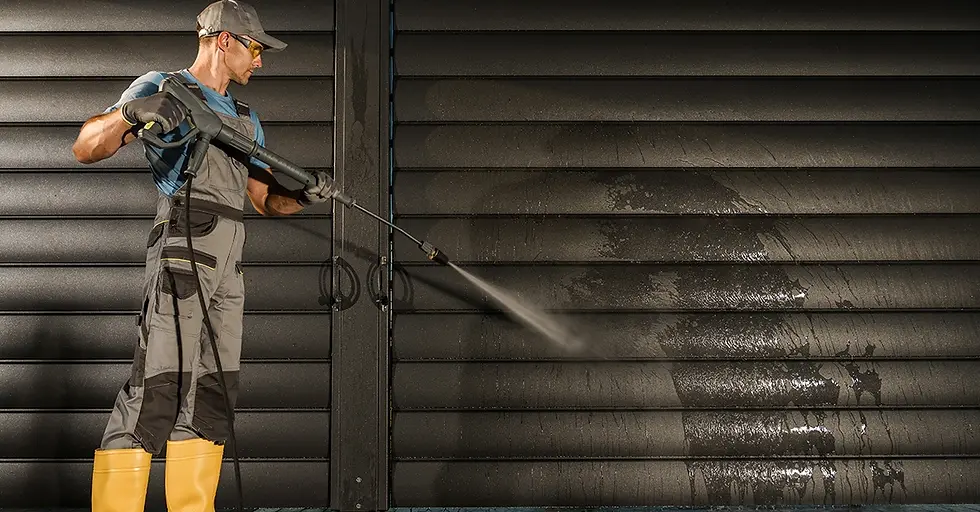

Running a pressure washing business comes with exciting opportunities and serious risks. From high-pressure equipment to chemical cleaners and property exposure, the potential for accidents or damage is real. That’s why having the right insurance coverage is essential to protect your business, your clients, and your bottom line.

At Wexford Insurance, we specialize in helping pressure washing professionals secure tailored insurance solutions. Whether you're just starting out or scaling your operations, this post will guide you through the essential types of insurance your business needs to stay protected and compliant.

Why Pressure Washing Businesses Need Insurance

Pressure washing involves more than just cleaning surfaces. You’re working with powerful equipment, often on client property, which opens the door to liability claims, equipment damage, and even environmental violations. Insurance helps you:

Protect against lawsuits and property damage

Replace or repair stolen or damaged equipment

Comply with local regulations and licensing requirements

Build trust with clients and commercial partners

Essential Insurance Coverage for Pressure Washing Businesses

This is the foundation of your coverage. It protects your business from third-party claims of:

Bodily injury (e.g., someone slips on a wet surface)

Property damage (e.g., water damage to a client’s home)

Legal defense costs

2. Equipment Insurance (Inland Marine)

Your pressure washers, hoses, nozzles, and surface cleaners are vital to your business. Equipment insurance covers:

Theft or vandalism

Accidental damage

Transportation-related losses

If you use a vehicle to transport your equipment or travel to job sites, you’ll need commercial auto coverage. It protects against:

Accidents involving your business vehicle

Damage to third-party property

Medical expenses for injuries

If you have employees, most states require workers’ comp. It covers:

Medical expenses for work-related injuries

Lost wages

Legal costs if an employee sues

Environmental Compliance and EPA Guidelines

Pressure washing businesses must follow EPA regulations, especially when dealing with lead-based paint or wastewater runoff. According to the EPA’s RRP Rule, you must:

Contain wastewater and debris

Prevent runoff into storm drains

Use proper disposal methods

Check with your local water authority for additional requirements.

Recommended Equipment Vendors

Choosing reliable equipment is key to minimizing breakdowns and insurance claims. Trusted vendors like PowerWash.com offer:

Gas and electric pressure washers

Soft wash systems

Surface cleaners and accessories

Financing options for startups

Why Work with Wexford Insurance?

We understand the unique risks of pressure washing and offer insurance programs tailored to your industry. Our team works with reputable carriers and provides expert guidance to help you stay compliant and covered.